Picture this: it’s Monday morning, and your CRO is asking why pipeline coverage remains thin despite marketing delivering record lead volumes. Your sales team is drowning in unqualified prospects. Your board wants proof that last quarter’s demand generation spend actually moved revenue, not just vanity metrics.

This tension sits at the heart of every European revenue organisation right now. The pressure to demonstrate ROI has never been more intense, yet the tactics most teams default to (mass outreach, aggressive upselling, spray-and-pray prospecting) are actively working against them.

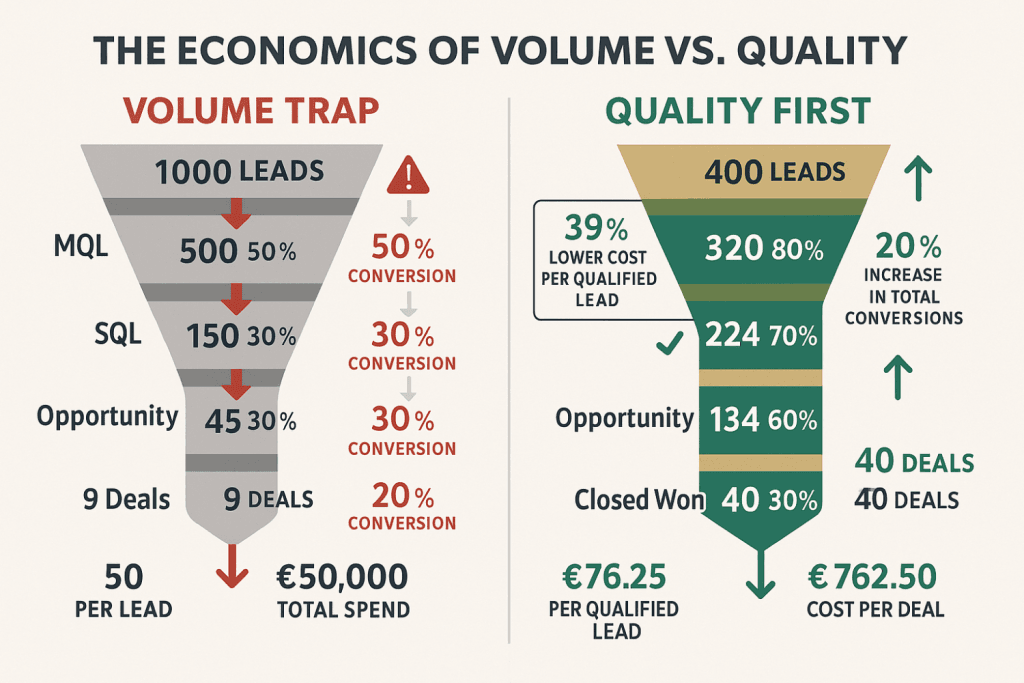

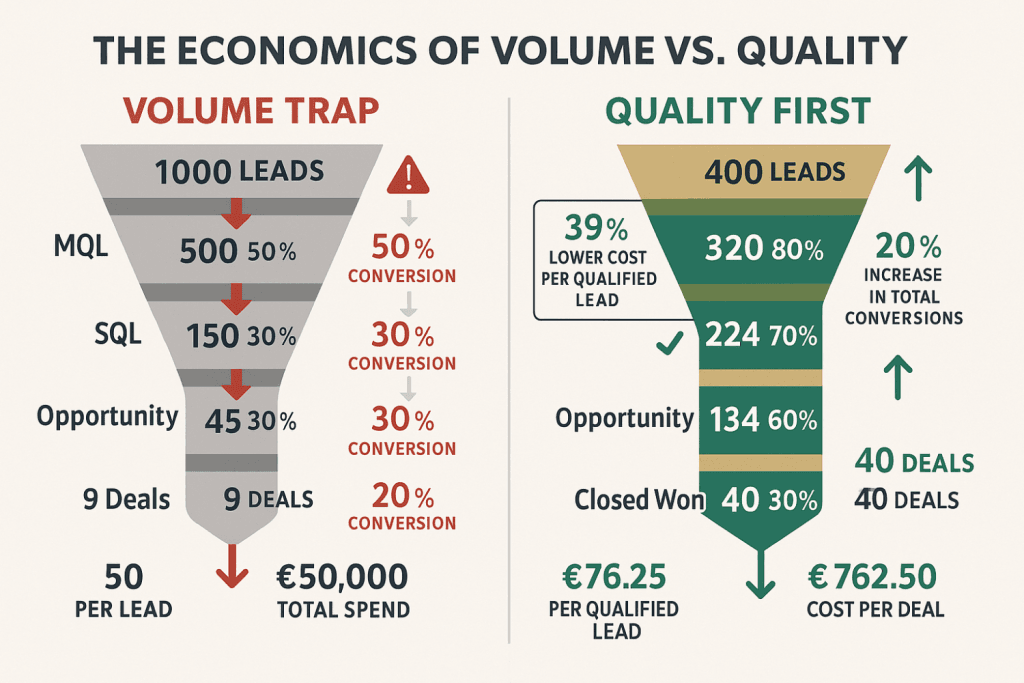

New research reveals something European revenue leaders need to hear: quality-first strategies aren’t just more ethical, they’re dramatically more profitable. We’re seeing 39% lower cost per qualified lead, 45% more opportunities created, and conversion improvements of up to 270% when organisations abandon volume thinking. The businesses winning in sophisticated European markets aren’t those generating the most activity. They’re those generating the right activity at the right moments.

This isn’t theory. It’s a fundamental shift already underway across European B2B, and the evidence suggests those who don’t adapt will find themselves outspent and outmanoeuvred by competitors who’ve cracked the quality code.

The businesses winning in European B2B aren’t those generating the most activity—they’re those generating the right activity at the right moments.

The Volume Trap: Why More Leads Often Mean Less Revenue

Here’s the uncomfortable truth most revenue teams won’t acknowledge: the ‘more leads’ mandate is actively destroying pipeline quality.

LinkedIn Marketing Solutions data shows that organisations shifting focus from raw lead volume to qualified pipeline criteria achieved a 39% decrease in cost per qualified lead. Not marginal gains. A fundamental restructuring of unit economics.

Yet 87% of B2B marketers still struggle to measure long-term campaign impact, defaulting to the metrics they can easily track: form fills, downloads, webinar registrations. These vanity metrics create a dangerous illusion of progress whilst sales teams waste cycles on prospects who were never going to buy.

The Real Cost of Volume Thinking

- Unqualified leads clog your sales funnel, extending average sales cycles

- Sales reps lose confidence in marketing-sourced pipeline

- Your MQL-to-SQL conversion rate tanks (the average B2B organisation takes 3+ months to convert)

- Revenue forecasting becomes unreliable because your denominator is polluted

The Quality Alternative in Action

Early adopters focusing on MQL and SQL pipeline criteria (rather than top-of-funnel volume) report up to 20% increase in total conversion volume through smarter targeting. The counterintuitive insight: by pursuing fewer leads more strategically, they’re actually closing more business.

For European revenue leaders facing board pressure, this reframe matters: you’re not arguing against growth. You’re arguing for a growth model that compounds rather than depletes.

The 7x Conversion Gap: Capturing Intent at Peak Moments

Consider your own buying behaviour. When you’ve decided you want something (you’ve done the research, compared options, and you’re ready to act) what happens when a vendor makes you wait?

Your European B2B buyers are no different. Research confirms they spend 80% of their purchasing journey in independent research before ever engaging your sales team. By the time they raise their hand, they’re not looking for more information. They’re looking for a path to action.

This is where most lead capture strategies catastrophically fail.

The Friction Problem

Traditional lead capture assumes a delayed follow-up model: prospect fills form, enters nurture sequence, eventually gets sales call days or weeks later. But intent is perishable. The mental state that prompted engagement doesn’t persist indefinitely.

The Breakthrough

Lead Gen Forms featuring instant appointment booking deliver 7x higher click-through rates after submission compared to external scheduling links. Seven times. Not 7%, seven times more engagement.

Why? Because you’re converting at peak intent rather than hoping that intent survives your follow-up delay.

Questions to Pressure-Test Your Current Approach

- How many hours elapse between form submission and meaningful sales contact?

- What percentage of your MQLs never respond to outreach despite requesting contact?

- Are you measuring lead volume or qualified pipeline velocity?

For sales directors watching conversion rates plateau, the implication is clear: your capture mechanism may be the bottleneck, not your sales team’s capabilities. The solution isn’t more leads. It’s removing friction at the moment of maximum buyer commitment.

By pursuing fewer leads more strategically, they’re actually closing more business.

Social Selling’s 78% Advantage: What the Data Actually Shows

The phrase ‘social selling’ has been diluted to meaninglessness through overuse. But strip away the jargon, and the underlying research tells a compelling story about what’s actually working in European B2B sales.

LinkedIn’s analysis reveals 78% of social sellers outsell their peers who rely on traditional outbound methods. Social selling leaders create 45% more opportunities than those depending on cold outreach alone.

These aren’t marginal improvements. They represent a fundamental performance gap that European sales organisations can no longer ignore.

Why This Works in European Markets Specifically

European B2B tech buyers consistently demand genuine help before making purchasing decisions. The consultative, relationship-first approach that defines effective social selling aligns perfectly with these expectations. Contrast this with US-style volume outreach, where aggressive SDR cadences trigger immediate resistance from buyers who’ve learnt to distrust transactional engagement.

The Activity Metrics Paradox

Sales leaders often face pressure to track activity volume: calls made, emails sent, touches logged. Yet the data proves relationship depth predicts pipeline better than contact volume. This creates an internal tension worth confronting directly.

Ask yourself: are your sales metrics measuring effort or effectiveness? Are you rewarding activity or outcomes?

The Automation Warning

Only 11% of UK SMEs use AI ‘to a great extent’ for sales automation, despite growing adoption elsewhere. This isn’t necessarily lag, it may be wisdom. Expert consensus warns that over-automated direct offers trigger buyer resistance in European markets that value personal trust. B2B service firms achieving 46% AI adoption rates demonstrate faster ROI by focusing on quality interactions, not volume automation.

The takeaway for growth operators: technology should amplify relationship-building, not replace it. The 78% advantage comes from authentic engagement, not automated spray-and-pray.

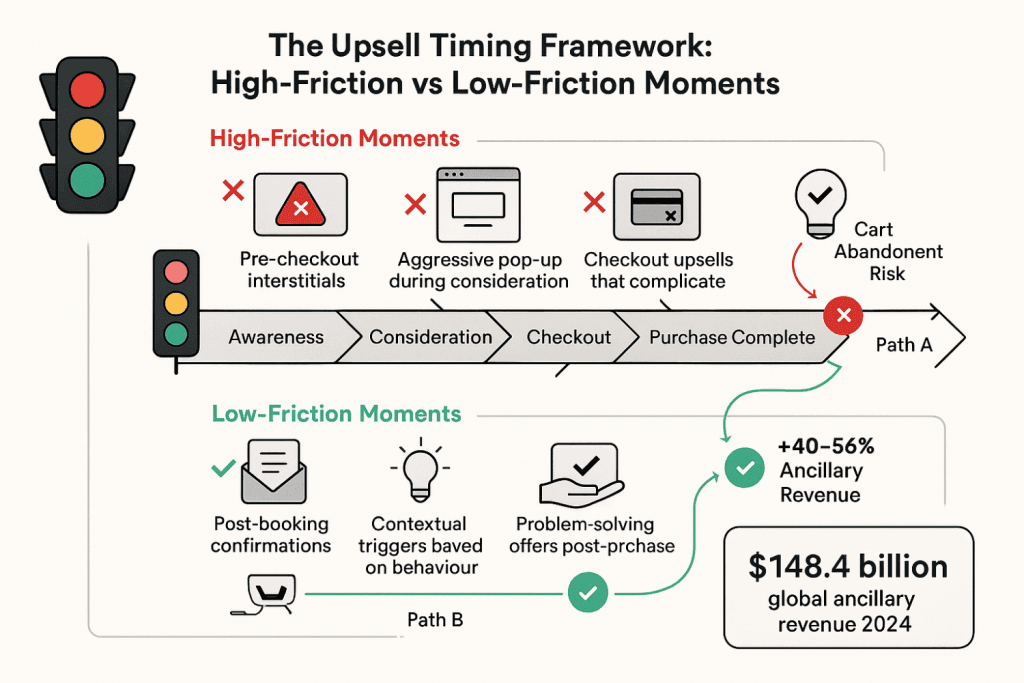

The Upsell Timing Revolution: $148.4 Billion in Non-Annoying Revenue

Global ancillary revenue reached $148.4 billion in 2024. Low-cost carriers now generate 40–56% of total revenue from add-ons and upsells. But here’s what separates the winners from the also-rans: it’s not about upselling more aggressively. It’s about upselling at moments when offers feel helpful rather than manipulative.

The Customer Journey Insight

Research across European hospitality, travel, and ecommerce sectors reveals that the highest-converting upsell moments happen post-purchase, when trust is already established, not during checkout when you risk losing the primary sale.

This contradicts the maximise-every-touchpoint mentality that dominates most revenue operations. But the data is clear: presenting choices when customers have mental space (rather than when they’re focused on completing a transaction) accelerates adoption whilst reducing brand damage.

Mapping Low-Friction vs High-Friction Moments

High-friction (avoid):

- Pre-checkout interstitials that delay purchase completion

- Aggressive pop-ups during consideration phase

- Upsells that complicate simple transactions

Low-friction (optimise):

- Post-booking confirmations with relevant add-ons

- Contextual triggers based on demonstrated behaviour

- Problem-solving offers that enhance existing purchases

The Cross-Industry Validation

The shift from ‘maximise every touchpoint’ to ‘solve customer problems at the right moment’ works across sectors: airlines, hotels, SaaS, professional services. The 270% improvement gap between optimised and basic approaches demonstrates that execution, not just presence, of revenue tactics determines outcomes.

For B2B marketing directors, the framework translates directly: are your expansion revenue efforts enhancing customer experience or eroding trust? The timing audit may be more valuable than the campaign optimisation.

Evidence-Based Credibility: The 270% Conversion Gap Your Competitors Are Ignoring

Here’s a statistic that should reshape how you think about social proof: the gap between 10% and 270% B2B SaaS conversion improvement comes down to deploying multi-format, evidence-based social proof rather than generic testimonials.

Not ‘having’ testimonials. Deploying them strategically, with specificity and credibility.

What European B2B Buyers Actually Need

Your sophisticated buyers don’t want aspirational marketing hype. They demand:

- Data-backed proof points with specific metrics

- Measurable outcomes from comparable organisations

- Third-party validation that reduces perceived risk

All 58 top-growing SaaS companies analysed use strategic social proof because buyers won’t commit without peer validation and proven outcomes. This isn’t optional. It’s table stakes.

The ‘Receipts Test’

Apply this quality filter to your current credibility assets: if you can’t show specific numbers and outcomes, your social proof isn’t working. Generic endorsements (‘great product, highly recommend’) don’t move sophisticated B2B buyers. Numbers, outcomes, and receipts do.

The European Competitive Advantage

GDPR awareness and regulatory consciousness have created a higher bar for evidence quality across European markets. Rather than viewing this as constraint, revenue leaders can position thoughtful, evidence-based social proof as a competitive differentiator.

Organisations implementing comprehensive social proof strategies across multiple touchpoints (customer success metrics, case studies with specific outcomes, third-party validation) create credibility engines that measurably shorten sales cycles.

For revenue operations leaders, this means auditing your proof assets with the same rigour you’d apply to pipeline data. What percentage of your case studies include specific, quantified outcomes? How are those assets deployed across the buyer journey? The 270% gap suggests most organisations are leaving conversion on the table through weak credibility execution.

Making the Shift: From Volume to Quality

The pressure you’re facing is real. Boards want growth. Investors want efficiency. Sales teams want better leads. Customers want genuine value, not manipulation.

The evidence from this research suggests these aren’t competing demands. They’re aligned when you shift from volume thinking to quality thinking.

The Numbers Worth Remembering

- 39% lower cost per qualified lead through pipeline-focused optimisation

- 7x higher engagement through instant-action lead capture

- 78% sales outperformance through relationship-first selling

- 270% conversion improvement through evidence-based credibility

- 45% more opportunities from quality engagement versus volume outreach

What to Stop

- Measuring success by lead volume rather than qualified pipeline velocity

- Upselling at high-friction moments that damage trust

- Relying on generic testimonials instead of specific, quantified proof

- Rewarding sales activity metrics over relationship depth

What to Start

- Auditing your customer journey for low-friction revenue moments

- Integrating instant-action CTAs at points of peak intent

- Building credibility engines with the ‘receipts test’ as your quality bar

- Positioning European regulatory awareness as competitive advantage, not compliance burden

The businesses winning in European B2B aren’t louder or more aggressive than their competitors. They’re more precise. They understand that sophisticated buyers with GDPR-shaped expectations and access to independent research don’t respond to volume tactics. They respond to value, delivered at the right moment, backed by evidence they can trust.

That’s not just a more sustainable growth model. It’s a more profitable one. And it’s the argument you now have data to make internally, the next time someone asks for ‘more leads.’

0 Comments